Demystifying inflation

Simple guide for business and shared services people about causes and implications of the inflation.

You hear about inflation almost every day, don’t you?

But do you understand what is at stake? Why to watch the customers? Why to evaluate their responses to the inflation?

This blog provides you short answers to these questions.

What is inflation?

Inflation means prices of goods and services rise broadly and permanently, in an economy.

Broadly – when many products and services are involved. Permanently – when the increase continues beyond 2 years.

Inflation typically impacts a currency and a geographical region using that currency, as described by the annualised CPI (Consumer Price Index).

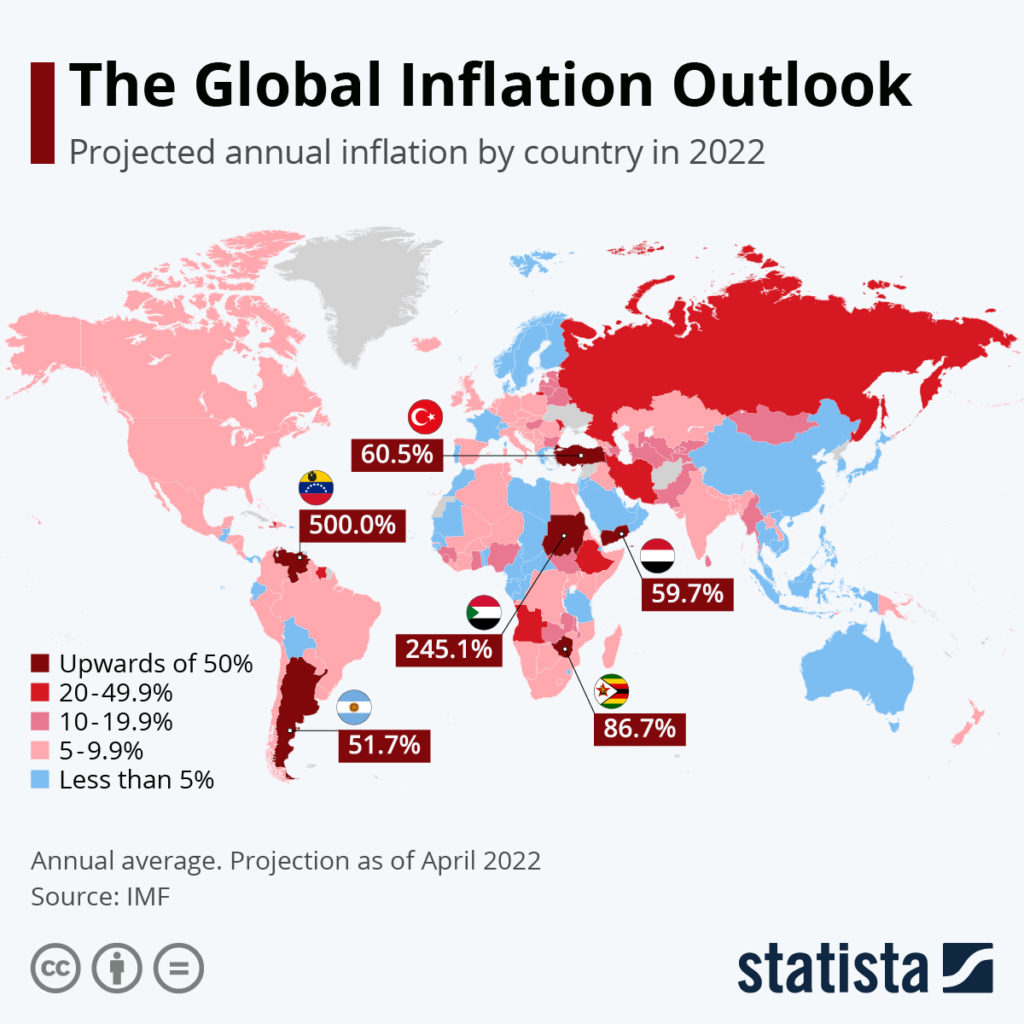

When general price levels rise, each unit of a currency buys fewer goods and services, consequently the purchasing power of that money sinks. See 2022 trends in the chart below.

The International Monetary Fund expects inflation to be around 9% by the end of 2022. Developed countries can be around 4.5 % average, whereas developing nations e.g., Brazil, Turkey, Sudan, can easily reach hights of +50%.

Prices climb either because costs of products increase or because demand for goods and services substantially increases.

Cost-push inflation

You face a “cost-push” inflation when the supply of goods becomes limited.

The oil price increase in the 1970s, when the Organization of Arab Petroleum Exporting Countries imposed an embargo against the United States, caused such a cost-push. The implemented cuts saw the oil price nearly quadruple from 2.90 US-dollars a barrel to 11.65 US-dollars a barrel in 4 years.

Another example was the African Swine Fever in 2019, which forced China to cull more than a million pigs. The result? Meat prices rose by 110% within a year, pushing Chinese inflation to an eight-year high.

Demand-pull inflation

Inflation can be “pulled” by the raising demand. Governments for example, by spending more on military, healthcare, education or infrastructure, will actively subsidize inflation.

Households, when they feel confident about the economic prospects, incline to spend more. We saw such overspending in Greece in the early 2000’s.

Sudden demographic changes can cause exponential growth in young age groups, which can easily lead to a permanent increase in demand for food, beverages, and clothing – as happened in Turkey between 2004-2018.

Growing number of senior citizens pulls demand for healthcare services, medications and health prevention, in general. This age group, looking for active after-retirement times, boosts demand for “senior citizen friendly” resorts like the “The Village” in Florida, for example.

Why does inflation accelerate in 2022?

Inflation is a complex phenomenon!

CPI is influenced by the demand for goods and services; the available natural resources and labour; and the leading fiscal policies of a country. Depending on the relative weight of these factors – inflation may vary significantly between countries.

Economies are interconnected. You can see the post pandemic effect and the implications of the Ukraine- Russia effecting price levels in most countries.

Post-Covid Supply bottle neck: cost-push

Lockdowns led to severe disruptions in supply chains. The zero Covid policy in China caused a stoppage of manufacturing, resulting in Taiwan; Vietnam; Malaysia; and other Asian countries to push up prices.

The most severe bottlenecks affected raw materials, intermediate manufactured goods, and freight transports.

Metal and minerals sourced from China, magnesium nickel, copper, tin, zinc etc. pushed up prices. The outfall of Russian energy and metal, reinforced the shortage, further increasing prices to historical heights.

Shutdown of semiconductor plants in Malaysia, had a significant impact on global chip production. Closure of Vietnamese factories impacted apparel and footwear retailers, like Nike or Under Armour.

Cargo and Ports were heavily impacted by the pandemic. Many were closed, and labour was sick and scarce. As petrol prices became more expensive freight rates grew about five times their average over the past decade. See transportation from Asia to North America and from Asia to Europe reached all-time highs early 2022, forcing manufacturers to scale back production or increase their product prices, too.

Too much money: demand-pull

Governments launched fiscal stimulus programs to support companies during the pandemic.

In the United States alone, a $1.9 trillion fiscal stimulus was introduced. Globally, around $16.9 trillion in fiscal measures was announced to fight the pandemic, largely in advanced economies. Most economists agree that stimulus programs contribute to the raising inflation: “too much money chasing too few goods”.

In addition to printing money post pandemic recovery drove additional demand for durable goods, for example housing and cars. Households were running down the savings they had accumulated earlier in the pandemic, which led to a surge in aggregate demand.

Shock to labour supply: cost-push

Labour market disruptions from the pandemic continued in 2022. Many who left the workplace during the pandemic, haven’t yet returned. Participation of women, part time employees, and the younger generation have not yet stabilised. A shortage of labour, together with setbacks triggered by new corona-variants, have contributed to the labour-cost increase. According to ILO employment shortfall will likely persist “moving forward” and “contribute significantly” to inflationary pressure in many countries.

Vacancies grew within the IT sector. The shortage of developers and IT service providers rose worldwide; the Russia-Ukraine war cut out an important “developer population” from the market. India capacities became instable too, just to mention a few key reasons. The shortage of skilled labour increased digital solution prices by 4-7%, effecting large tech firms like Google and Amazon, and ultimately impacting the consumer.

Scarce energy and food (consequences of the Ukraine war): cost-push

The February 2022 invasion has led to rising energy and food prices, globally.

Both Russia and Ukraine are exporters of major commodities, and the disruptions from the war and the sanctions have made prices to soar affecting oil, natural gas, aluminium, copper, nickel prices.

Ukraine and Russia account for 30 percent of global wheat exports. Fertilizer and wheat production in the war-zone was disrupted, causing prices to reach record highs. The impact is bigger for low-income countries, where food and energy are a larger share of consumption

What is the impact on your customers?

Generally speaking, inflation creates a perfect storm for businesses in terms of cash-flow and revenue.

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” Ronald Reagen, 1978 – when inflation was running at 9% on its way to 15% 2 years later.

Businesses face various risks within the current inflationary environment, too.

Growing product and overhead expenses if not compensated with higher revenue can easily result in reduced profits. Businesses might be afraid of the reduction of their customers’ purchase power and could be opting for absorption of their higher expenses, instead of following the price increase.

Companies might face borrowing difficulties; banks refusing loan applications and granting lower credit ratings. Most of them will likely push suppliers’ credit to optimise their cash-flow.

Who suffers the most when prices are rising?

First and foremost, the savers – because higher prices lower the real value of their savings.

Employees who are tied to fixed-wage contracts are also impacted, as are commercial banks who have fixed interest-rate returns on the money they have loaned.

Then there are the importers whose goods typically become more expensive when their domestic currency loses value against currencies with lower rates of inflation.

Who are the winners?

Certainly, there are always some winners from higher prices: as a rule, anyone with debts at a nominal fixed interest rate.

Those who have the power to borrow money at fix rate and invest it into assets granting a return above the inflation rate will increase their wealth.

Companies with high levels of debt, with a fixed borrowing rate will also benefit. Often, an inflationary environment makes it possible for those companies to pass on price increases to consumers. The “additional money” which is generated can be used to service existing debt.

In addition, private individuals who have invested in so-called inflation hedging (material assets such as real estate, commodities or gold), may also benefit when the value of their investments ultimately increase.

Talk to your customers

What counts the most: how does your customer react to the inflationary pressure? In your credit role, you want to be able to answer find responses to this question.

This, you cannot see in their past business reports! The best method is to talk to them.

When discussing, try to understand their financial situation in respect to borrowing and investments. On which side of the scale would they be? On the “losers” or the “winners”?

What are their responses to the inflation? Do they revisit their product mix and cut out their low profit margin offering? Are they able to revisit their pricing strategy?

Have they found alternative sourcing? Are they in a position to reduce their material costs? Have they cut back non-essential expenses?

Do they embrace lean in adjusting their organisation? Are they continuing to invest investing into people development? Are they improving their market reach? Do they maintain investments levels in R&D? Do their assets continue to provide a good return?

Did they investigate whether inflation and the pandemic have opened new opportunities for them? Do they plan their cash flow needs well ahead? Do they have plans on how to improve their cash flow?

How to optimise your customer portfolio?

How quickly price levels stabilise largely depends on central banks’ responses and the recovery of the supply chain. These are factors which you cannot easily predict.

Your challenge is to optimise your customer portfolio within such a volatile environment. Once you have gathered sufficient information you can pertinently assess the quality of your portfolio and decide which customer segment to support and which segment to securities.

Your challenge is to follow your customer through the changes, remain agile and support your business with prudent credit advice.

Get more tips from the following blog: –

ARE YOU PREPARED FOR AN ACCELERATING INFLATION? – Klass Academy

If you would like to hear more about credit risk assessment or share your inflation stories for feedback, feel free to contact us at contact@klassacademy.com.