ARE YOU PREPARED FOR AN ACCELERATING INFLATION?

Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.

Ronald Reagan

Reagan was certainly right! If it is not controlled vigorously, inflation can destroy economies, burden individuals and businesses.

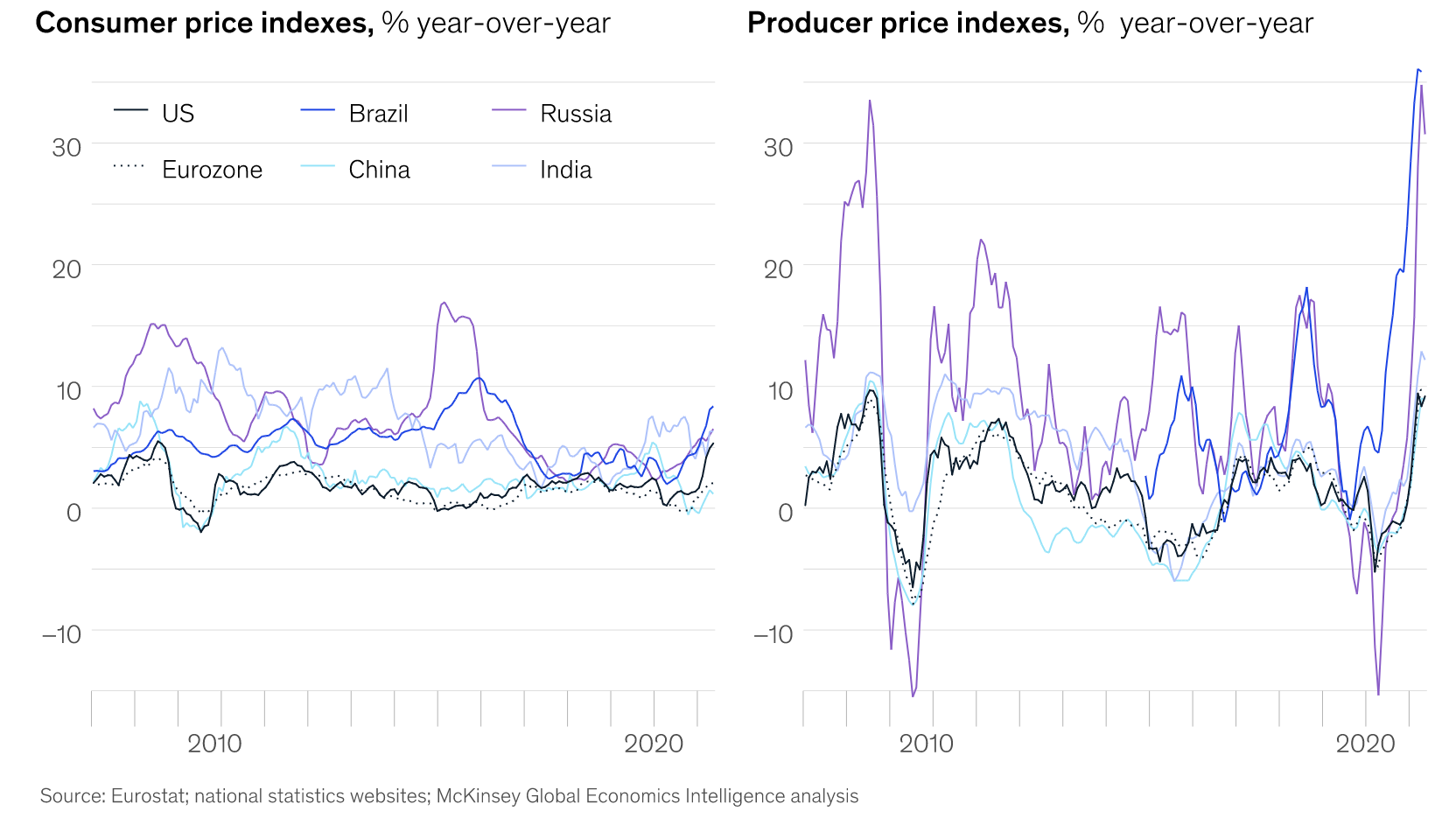

In 2021, we face inflation again. Annual inflation in the G20 area increased to 4.3% in May. The inflation rate in the USA is officially at 3.3%, the UK faces 2%, Hungary, Czech Republic and Slovakia report 2.2-2.7% price increase, predominantly in the food, the energy and the construction sectors. Inflation increased in all non-OECD G20 economies too, reaching 48.8% in Argentina, 6% in the Russian Federation, 8.1% In Brazil and 5.3% in India. Read details in the OECD statistics.

An alarming consequence of the pandemic

This happening as the alarming after-effect of the pandemic, driven by 3 main factors:

1. Increased money supply; many governments pumped cash of extraordinary volume into the economy, aiming to support companies during the pandemic.

2 Struggling Supply chain; the new waves of the pandemic have disrupted supply chain and as a consequence production is still low in most countries.

3. Energy and food prices have rocketed.

Inflation devalues us all

Prices increase rapidly, purchase power diminishes, and cash savings rapidly vanish in such times. Inflation may easily redistribute wealth between those who are well informed at the disadvantage of those who are behind. Inflation is a complex phenomenon, notably in the global world.

Credit manager positively influencing finances

Inflation is not just a mere price increase! To comprehend the background your customers currently operate, credit managers should evaluate the price increase in the context of the foreign exchange, the interest rates, tax and the governmental aids programs. By putting their customers under a specific magnifying glass, credit managers can positively influence finances of their companies.

Here are 7 tips on how to work proactively with your customers, during inflation:

Be prepared to increase your credit lines

If you increase your prices, your customers will certainly ask for higher credit lines. Be prepared that their credit request will increase, even if you keep supplying them with the same quantity!

Understand why they are asking for higher limits

Is additional credit required to cover the price increase of your products? Or do they request far more?

If your customer applied for a 20% higher credit line, while your own price increase is just 5% and your product supply is even, is a sign that they need additional liquidity, irrespective to your business.

If they invested into new products or acquired new markets, their need of additional liquidity is legitimate, and I would consider it as a “positive” move.

In contrast, if the increase is driven by their inability of passing on the cost increase to their existing markets and they face lowering sales, you should carefully watch them. If your supply is stable, the increase of credit application might indicate a shift of risk, for you.

A good credit manager will investigate underlying reasons beyond those of a growing credit demand. Increase credit, once you have proved the business evolution is positive!

Encourage them to Increase their debts with banks

Inflation “consumes” your saving. It “consumes” your debts as well, given you drive profitable operations and have the capacity to pay capital and interest at a pre-agreed, fixed rate.

All In all, you as a supplier should consider advising your customers to get credit from their bank, instead of asking it from you!

This could be a triple win if the conditions were collaboratively set up; a win for the bank by gaining new business; a win for the customer by getting more credit at fair conditions; and a win for you by granting them your standard terms.

Look into their M&A and investment strategies

If your customer has cash, this is the time to smartly invest it into other companies or a new production facility. No wonder M&A is soaring, and many corporates acquire companies of complementary profiles, at a rather high price!

Investing into production facilities where supply is short (food, energy, microchips, technology etc.) can create for them an additional capacity for growth, a positive development you might praise in your next credit write up.

Examine their operational costs

Have they managed to maintain cost levels despite the inflationary price increase? Best companies remain in control of the supply chain costs during inflation, by introducing efficiency measures.

If you see the increase of their operational cost running higher than the inflation rate, it is best you check out why.

Evaluate their overall capacity to sell

A major question during inflationary times is whether they can sell or not. If prices go up consumers often look for replacing products, at lower prices. Others, postpone their purchases. Companies, agilely reacting, by offering deals at a higher value and competitive price can be the winners of such a volatile period.

Companies waiting for their markets recovering will need to safeguard their liquidity with the help of their creditors – an effort you should probably steer clear from.

Investigate the impact of FX

If your customer is in your country – you both face the same inflationary challenge.

The question is where are your customers’ clients located? When they are within the same country, parameters are relatively simple to follow.

If they are predominantly export customers, you should check the country risk, FX and central bank rates of the concerned countries.

When the currency of your customer’s location devaluates against their customers’ country’s currency – their products will be less expensive and could result in higher sales for them.

Then, if your customer’s sales destination country devaluates their currency against your customer’s currency – their products will be perceived more expansive and could cause sales contracting.

The ultimate answer: boost “production”

It is not always easy to be a Credit manager and put the pieces of the “inflation puzzle” together. My advice is to support your sales yet stay alert.

By following these tips, you will be taking better credit decisions and you will be assisting your company in smart manoeuvring until production picks up, sales increase and economies recover from the shock of the pandemic.

Contact us with your questions

Klass Academy offers blended trainind for Finance, Sales and Order to cash people.