Accelerating efficiencies in Credit Management. How to find time to Innovate and Improve work-life balance?

ACMS Round table 21st of April, 2021

Klara Boor, Managing Director, Klass Academy moderated the discussion on this panel. The topic was about accelerating efficiencies in Credit Management and finding time to Innovate and Improve work-life balance during the COVID-19 pandemic. The panellists were Olga Glazko, SR Technics, Eduardo Serrano-Labelo, Sulzer and Sebastian Goetz, Glencore. They shared observations from their work including strategies and tactics. The workshop attracted around 25 people from different companies.

The first priority during the panel was to identify and understand the overall impact that the various financial realities have on business. Then, the insights were used from these indicators to identify good and bad practices.

The major takeaways were the following:

Stakeholders track bad debt, working capital cost, timely response and “customer satisfaction” as Key Performance Indicators. They use credit as a support function for the business to increase profitable sales. Shared services (SSC) focus on cost reduction.

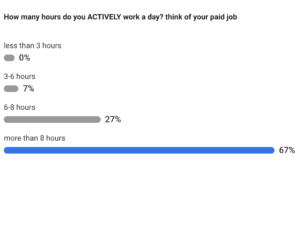

The pandemic had a controversial effect on the workload. It increased well above 8 hours, for many, others were forced to cut work time to 80-60%.

As an impact of challenges experienced throughout the pandemic, contract negotiations, structuring deals, and covering exposures required most credit professionals’ increased effort.

Strategies currently being used focus on communication. Panellists spent the most time with Internal communication, which has increased mainly due to discussions with the markets ( uncertainty stimulated by the pandemic) and to projects ( automatization and IT systems).

Companies, whose revenue was negatively impacted by the pandemic strengthened focus on controls, C- levels got often involved into daily operational activities. For Credit professionals research, analysis and decision-making remained the “number one” task.

Panellists increased efficiencies to respond to the headcount reduction and the intensified communication challenge.

Best practices:

Best practices included task lists shared with collaborators which increased visibility of individual and team tasks. These lists also provided a sense of routine for remote teams. Routines helped with pandemic anxiety and provided feelings of stability, and a sense of normalcy. Shared task lists allowed teams to better prioritise and focus on the issues first, which delivered the best outcome.

Better, more accessible, and robust collaboration tools have shifted from “nice to have” to a necessity. Asana and MS365 Teams were mentioned as proven best practices. Team discussions and internal communications have moved to MS Team ( or Slack) replacing internal emails.

Another best practice mentioned was cutting out repetitive tasks – replacing them via automated solutions. Gathering and storing financial , trade, master data and reporting information via automated tools helped the credit teams to reduce admin and low added value work.

In the last 2 years, the involvement of IT was great. The most resourceful companies worked on IT tools in good times, so that It gave them an advantage and a good return in the bad times.

The Panel included poll questions to gather participants’ opinions:

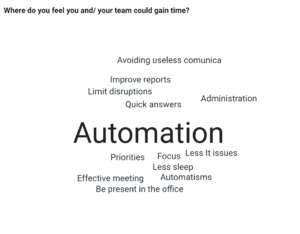

Poll: How do you feel you and your team could gain time?

Poll: How many hours do you actively work a day?

Poll: Do you feel workload has increased in the past 5-8 years?

Poll: Rank these activities with regards to the time they take

Major challenges identified:

– Motivating people throughout pandemic anxiety

– Finding time to finish IT projects

– Stopping disruptions due to the home office

– Finding time for personal activities

In conclusion, work is going through changes, including in the credit field. It tends to go two ways. On the one hand, there are people who use the time usually spent on “commuting” at their desk. On the other, there are those who feel they have more control over their daily schedule and organize their days more effectively.

For the credit field, efficient communication, increased IT contribution, helping teams to adapt to the new environment, research analysis and decision making are the most important tasks.

The meeting was closed with questions form the audience and Fintech Insights from Danny Kaltenborn, the president of ACMS.

Contact us with your requests or questions.